Mileagewise - Reconstructing Mileage Logs for Beginners

Mileagewise - Reconstructing Mileage Logs for Beginners

Blog Article

8 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe Best Strategy To Use For Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs - TruthsLittle Known Questions About Mileagewise - Reconstructing Mileage Logs.Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs Rumored Buzz on Mileagewise - Reconstructing Mileage LogsThe 7-Minute Rule for Mileagewise - Reconstructing Mileage LogsGetting The Mileagewise - Reconstructing Mileage Logs To Work

Timeero's Fastest Distance attribute suggests the quickest driving course to your employees' destination. This function boosts productivity and adds to set you back financial savings, making it an essential property for organizations with a mobile workforce.Such a method to reporting and conformity simplifies the commonly complex job of handling gas mileage costs. There are many benefits related to utilizing Timeero to maintain track of gas mileage. Let's take a look at some of the app's most notable attributes. With a relied on mileage tracking tool, like Timeero there is no need to bother with unintentionally leaving out a day or item of information on timesheets when tax time comes.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

These extra verification steps will certainly keep the IRS from having a reason to object your gas mileage records. With exact gas mileage tracking modern technology, your workers do not have to make rough gas mileage estimates or also stress about mileage expense tracking.

As an example, if a worker drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all car costs. You will certainly require to proceed tracking mileage for work also if you're making use of the actual expenditure method. Keeping gas mileage records is the only method to different organization and personal miles and give the evidence to the IRS

The majority of gas mileage trackers let you log your trips manually while determining the range and compensation quantities for you. Several additionally featured real-time trip tracking - you require to begin the app at the beginning of your journey and stop it when you reach your last location. These apps log your start and end addresses, and time stamps, in addition to the complete distance and reimbursement amount.

All About Mileagewise - Reconstructing Mileage Logs

One of the questions that The INTERNAL REVENUE SERVICE states that automobile expenses can be considered as an "ordinary and required" expense during doing organization. This includes expenses such as gas, maintenance, insurance policy, and the car's depreciation. However, for these prices to be considered deductible, the automobile should be used for service objectives.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

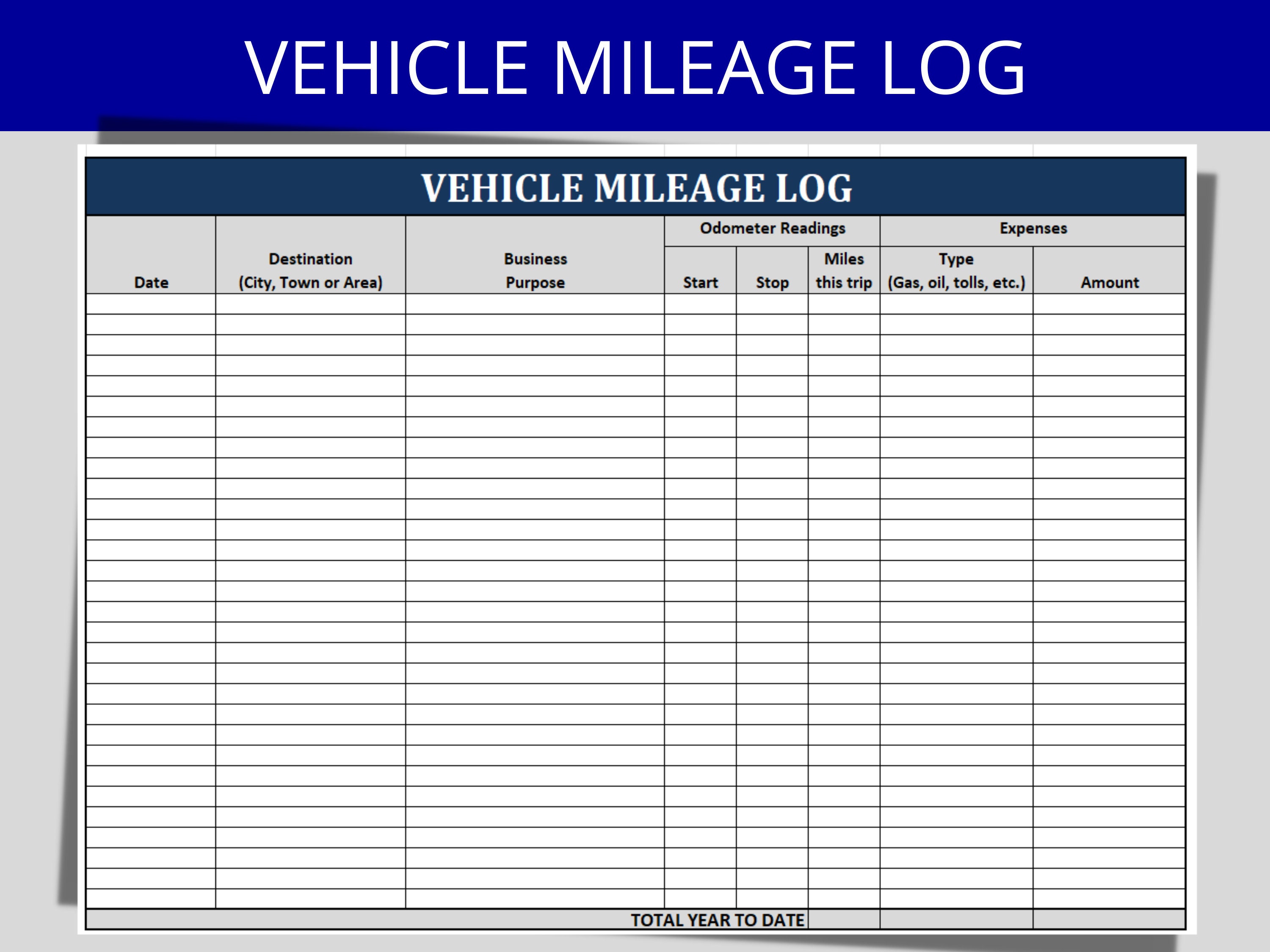

In in between, carefully track all your business trips keeping in mind down the beginning and ending readings. For each trip, record the location and business function.

This includes the complete service gas mileage and overall gas mileage build-up for the year (service + personal), journey's day, destination, and objective. It's vital to tape tasks immediately and preserve a coeval driving log detailing date, miles driven, and service purpose. Here's just how you can enhance record-keeping for audit purposes: Start with guaranteeing a meticulous mileage log for all business-related travel.

The Only Guide to Mileagewise - Reconstructing Mileage Logs

The actual expenses technique is an alternative to the typical gas mileage rate method. As opposed to calculating your reduction based on a fixed price per mile, the real expenses method allows you to subtract the real expenses connected with utilizing your car for organization functions - best free mileage tracker app. These prices include gas, maintenance, repair work, insurance policy, devaluation, and various other associated expenditures

However, those with considerable vehicle-related costs or unique problems may take advantage of the actual expenditures approach. Please note electing S-corp status can alter this estimation. Ultimately, your chosen approach ought to line up with your details monetary objectives and tax obligation scenario. The Requirement Mileage Rate is a procedure released each year by the internal revenue service to identify the insurance deductible prices of operating an auto for company.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Discussing

(https://www.indiegogo.com/individuals/38205225)Whenever you utilize your automobile for organization journeys, tape the miles took a trip. At the end of the year, once again write the odometer analysis. Compute your overall service miles by using your start and end odometer readings, and your tape-recorded company miles. Accurately tracking your exact mileage for service journeys aids in substantiating your tax reduction, specifically if you opt for the Requirement Gas mileage technique.

Keeping an eye on your mileage by hand can need diligence, yet remember, it could save you cash on your taxes. Follow these steps: Write down the day of each drive. Tape the total mileage driven. Take into Get More Info consideration noting your odometer readings prior to and after each journey. Write down the starting and finishing points for your journey.

Little Known Questions About Mileagewise - Reconstructing Mileage Logs.

In the 1980s, the airline industry ended up being the very first commercial users of GPS. By the 2000s, the delivery industry had actually adopted GPS to track bundles. And now nearly everybody utilizes general practitioners to obtain around. That means virtually everyone can be tracked as they go regarding their business. And there's the rub.

Report this page